Studying the S&P 500: Infrastructure, Mobility, and the Bottlenecks of Progress

How Vulcan Materials Reveals the Next Wave of Billion-Dollar Startups

I. Gradually, Then Suddenly

We live in a time of accelerating change. Technology and human knowledge continue to compound. As Ernest Hemingway observed in The Sun Also Rises, disruption tends to unfold in two phases: “Gradually, then suddenly.”

Howard Marks echoed this dynamic in his 2020 memo The Winds of Change:

Today, unlike in the 1950s and ’60s, everything seems to change every day. It’s particularly hard to think of a company or industry that won’t either be a disrupter or be disrupted (or both) in the years ahead.

For investors, this means there’s a new world order. Words like “stable,” “defensive” and “moat” will be less relevant in the future. Much of investing will require more technological expertise than it did in the past. And investments made on the assumptions that tomorrow will look like yesterday must be subject to vastly increased scrutiny.(emphasis mine)

Investing — especially early-stage venture investing — requires living with one foot in the future. The slope of technological progress is steepening, and yesterday’s playbooks are becoming obsolete.

So we must ask: What does a more prosperous world look like ten years from now? What are the structural inevitabilities — economic, technological, societal — that must become true for GDP to accelerate? And what entrenched obstacles are preventing us from getting there?

One framework to examine these questions is to study the S&P 500, a living index of the U.S. economy and our collective economic priorities. Roughly 36% of its constituents turn over every decade. That churn is a reflection of what problems get solved, which industries fail to evolve, and what technologies gain escape velocity.

As we look ahead to 2035, it becomes clear how many core sectors of the economy have yet to fully benefit from technology transformation. While companies like Apple, Google, and Meta defined the internet cycle — which made the distribution of information free, instant, and ubiquitous — we are now entering a new era: one defined not by on-demand information, but by on-demand intelligence.

As I wrote in A Unified Theory of Imagination, this coming cycle will be defined by a proliferation of imagination. AI will not merely automate tasks — it will augment the ability to invent and create. Humans will no longer be the sole agents of innovation. We will go from 8.2 billion minds to 8.2 trillion intelligent agents working to solve hard problems. That will expand the boundaries of what is conceivable, let alone achievable.

This essay is the first in a new series exploring these themes through the lens of companies in the S&P 500. The thesis is simple: the areas ripe for disruption are the ones blocking economic inevitabilities from being realized. More often than not, we will find that this leads us to often over-looked, perhaps unsexy, industries and companies that yet to realize the benefits of major technology transformation. But new technological primitives — from AI to robotics to computer vision — have dramatically expanded the design space for innovation.

We will be guided by a handful of questions: What inevitabilities must become reality to accelerate prosperity? What frictions are preventing them? And what companies — legacy or emerging — sit at the center of this tension?

I hope this series serves as a beacon for ambitious founders — or yet-to-be founders — eager to solve real, economically valuable problems.

Each piece will follow a repeatable structure:

We’ll begin with a macro-level inevitability we believe must become true to accelerate GDP growth.

We’ll study a relevant company in the S&P 500 whose business is central to this theme.

We’ll hunt for the obstacles preventing progress, and speculate on the kinds of novel solutions (and startups) that could unblock it.

II.The Inevitability: Cheaper and Faster Mobility

A simple mental model I use to evaluate companies is: do they enable a more prosperous future? One way to quantify that is whether they contribute meaningfully to GDP acceleration — on both an absolute and per capita basis.

From this framing, I anchor around a few first principles that I call inevitabilities: structural truths that must become reality for long-term prosperity to compound.

One of those inevitabilities is this:

The movement of matter (goods, services and people) becoming cheaper and faster will accelerate prosperity (and GDP).

If GDP is the sum of productivity across labor, capital, and resources, then mobility —our capacity to move goods, services, and people — is its circulatory system. More efficient movement amplifies productivity. It expands markets, compresses time, and reduces friction across the economy.

The central question then becomes: what structural obstacles are preventing that inevitability from materializing?

Let’s examine.

There are four core transportation modes: automobile, rail, ship, and plane. And each mode relies on four key components:

Materials to assemble vehicles

Energy to power them

Infrastructure to facilitate movement

Intelligence to operate them

AI has the potential to dramatically reduce the cost of intelligence across this stack. Full-self driving (FSD) vehicles have been the most significant innovation to solve the main obstacles at the intelligence edge. AI enables autonomous operation of transportation, mainly automobiles, which helps drastically reduce the cost of operating transportation, which has largely been stagnant for the past generation.

This helps makes the movement of goods, services and people cheaper. At the same time, it increases utilization as on-demand intelligent vehicle operators become cheap and abundant, which reduces and eliminates downtime, wait and delays, making the movement of goods, services and people faster.

In a world where full autonomy is commonplace, the average cost per mile begins to approach the cost of energy alone — currently around $0.50/mile. As Jevons Paradox predicts, this efficiency will create more demand: we’ll move more goods, serve more regions, and connect more people.

Consequently, the rise of full self-driving systems introduces cheap, scalable intelligence into the transportation stack, which reduces the marginal cost per mile and increases utilization.

But that efficiency introduces new pressure. More vehicles moving more miles more often means exponential wear on roads, bridges, ports, and rail. The bottleneck shifts from intelligence to infrastructure.

And that’s where we find the next major constraint — and the next major opportunity.

The United States' infrastructure is aging and underprepared. The American Society of Civil Engineers gave U.S. infrastructure a C in its 2025 report card (source). Roads earned a D+. The average bridge is 47 years old. Many dams are over 60. The infrastructure investment gap this decade: $2.6 trillion. Roads, dams and bridges need to be repaired.

At the same time, demand is surging. The U.S. is still 3–5 million homes short. The Infrastructure Investment and Jobs Act will deploy $1.2 trillion, including $110B for roads and bridges, $66B for rail, and $25B for aviation. Reindustrialization via the CHIPS Act, EV supply chains, and data center construction will require massive foundational inputs. Every semiconductor fab needs 200,000+ tons of concrete; data centers consume 50,000+ tons in structural aggregate.

All of these projects demand the same building blocks: crushed stone, sand, and gravel. These are called construction aggregates.

Yet, we are colossally supply constrained. We don’t have enough construction aggregates to support existing repair demand, let alone new infrastructure construction. This is a massive problem that prevents faster and cheaper mobility, which prevents GDP acceleration and prosperity.

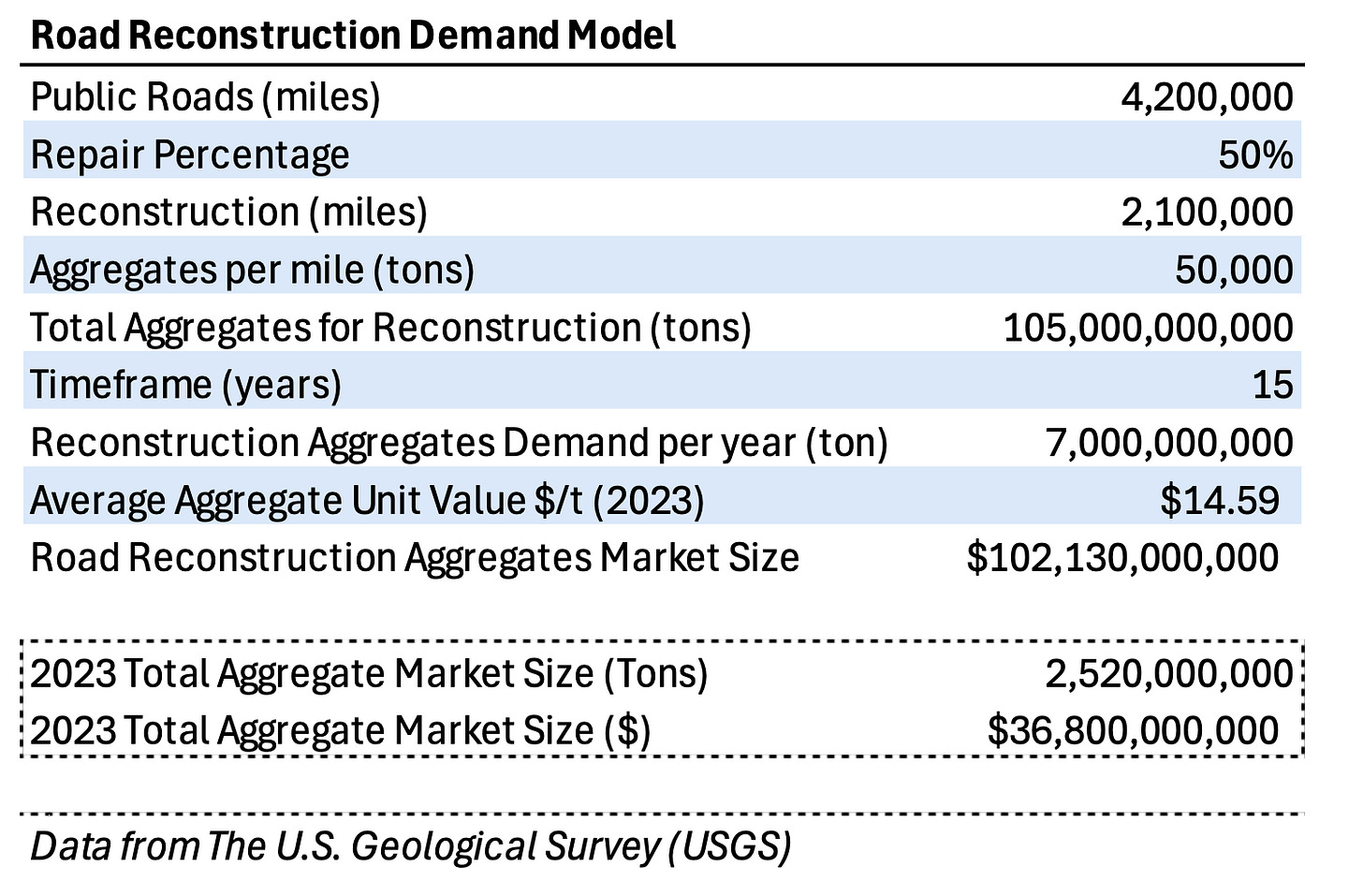

For example, the United States has approximately 4.2 million miles of public roads. If we assume half need major rehabilitation over the next 15 years and reconstruction requires roughly 50,000 tons of aggregates per mile, we will need 105 billion tons of crushed stone, sand, and gravel just for road repair, not counting new construction. On a yearly basis, this will demand 7 billion tons of construction aggregates worth a value of $102B — roughly three times larger than the total construction aggregates market size today.

Now imagine 10x more vehicles moving 10x more miles. The Infrastructure Investment and Jobs Act's $1.2 trillion represents a down payment, not a solution.

The construction aggregate market is a key primitive to both mobility and the built environment. They are the foundational substrate that everything else builds upon.

Concrete: 60–80% aggregates by volume

Asphalt: 90% aggregates by weight

Roads: Every layer from sub-base to surface course includes specific grades of crushed stone

Water, electric, and telecom infrastructure: All rely on trench fill, bedding, and drainage aggregates

As of 2023, there are approximately 3,531 quarries in the United States producing crushed stone, operated by 1,322 companies. In addition, there are 6,324 pits producing construction sand and gravel, operated by 3,100 companies, but these are typically classified as "pits" rather than "quarries".

But there is one company that dominates them all.

III. Vulcan Materials

Vulcan Materials ($VMC) is America’s largest supplier of construction aggregates and a top producer of asphalt and ready-mix concrete. The vast majority of Vulcan’s $7.4B of revenue in 2024 was generated from its quarry operations, specifically the production and sale of aggregates such as crushed stone, sand, and gravel. As of Q1 2025, Vulcan posted 13.5% YoY revenue growth, 9% aggregate price increases, and operating leverage-driven margin expansion.

With over 420 facilities, 15.6 billion tons of reserves, and quarterly shipments exceeding 47 million tons, and a vertically integrated operation that touches everything from quarry to job site, Vulcan is the invisible infrastructure engine beneath the U.S. economy.

Founded in 1909, Vulcan grew through over 100 acquisitions to become the largest producer of construction aggregates in the U.S. It consolidated a highly fragmented industry by identifying and acquiring quarries near high-growth metro areas, particularly in the Sunbelt.

Its strategy has always been simple but powerful: build density near demand. Aggregates are heavy and low value per ton. Hauling them more than 50 miles is usually uneconomical. So Vulcan built quarries near high-growth metro areas and created hyperlocal monopolies protected by regulatory and logistical moats.

Vulcan Materials’ core business is remarkably simple:

Extract limestone, granite, and other rock types from quarries through drilling and blasting

Crush and screen them into different sizes (base rock, sand, gravel)

Deliver them to distribution centers, concrete plants, asphalt facilities and construction site via truck, barge, or rail

In this context, Vulcan becomes something unique: a vertically integrated, geographically monopolistic materials company embedded in GDP itself.

Vulcan’s advantages compound and the company benefits from a number of moats.

Regulatory Moat: Permitting is slow and painful. NIMBYism keeps competition out.

Logistics Moat: Hauling rock is expensive. Freight costs make distant competition uneconomic. Local quarries win.

Integration Moat: Owning both upstream (quarry) and downstream (asphalt, concrete) layers captures more margin.

Demand Embeddedness: 990%+ of revenue tied infrastructure, housing, industrial projects.

And yet, even Vulcan can’t fully keep up. Their dominance hides major bottlenecks that offer fertile ground for startup innovation.

IV. The Constraints That Create Opportunity

Vulcan's dominance masks significant vulnerabilities that illuminate the next generation of startup opportunities. Significant structural constraints prevent faster, cheaper infrastructure development that economic prosperity demands.

Weather dependence cripples operations and reveals systematic blindness.

Vulcan's aggregate shipments decreased 10% in Q3 2024 due to rainfall and hurricanes across the Southeast. Weather risk presents a fundamental limitation of an industry that operates essentially the same way it did 50 years ago, hoping for sunny skies and reacting to weather rather than anticipating it.

Consider the cascading effects: when rain stops quarry operations, crushing equipment sits idle while fixed costs continue. When storms delay truck deliveries, construction projects fall behind schedule, creating ripple effects across entire development timelines. The industry lacks sophisticated weather intelligence that could optimize production schedules, pre-position inventory, and coordinate with downstream customers to minimize weather-related losses.

The opportunity: hyperlocal weather intelligence platforms that combine NOAA forecasts, on-site sensor networks, and construction scheduling data to optimize quarry operations. Think Tomorrow.io meets industrial operations management, with predictive analytics that could reduce weather-related production losses by 20-30%.

Site identification remains primitive despite massive data availability.

Finding new quarry locations requires geological surveys, environmental assessments, and regulatory analysis that can stretch across a decade. Companies still rely heavily on local relationships, manual prospecting, and reactive approaches to land acquisition rather than systematic intelligence about subsurface geology, regulatory pathways, and economic demand patterns.

The inefficiency is staggering. Vulcan and its competitors collectively spend hundreds of millions of dollars annually on exploration and permitting, much of it wasted on sites that ultimately prove unviable. Meanwhile, advances in satellite imagery, subsurface modeling, and regulatory data analysis remain largely under-utilized in the aggregates industry.

The opportunity: AI-powered geological and permitting intelligence platforms that analyze satellite imagery, subsurface data, macroeconomic demand signals, and regulatory patterns to identify high-potential quarry sites while auto-generating environmental impact assessments and zoning applications. This could compress 7-10 year development cycles into 3-5 years while dramatically improving success rates.

Transportation costs devour margins and limit market expansion.

Moving rocks costs more than the rocks themselves in many markets, creating artificial scarcity even when raw materials are abundant. The industry hasn't meaningfully innovated around logistics coordination, relying on the same hub-and-spoke trucking model that creates inefficient routing, empty backhauls, and capacity constraints during peak demand periods.

This constraint becomes more problematic as infrastructure investment accelerates. Projects often face delays not because aggregates aren't available, but because transportation capacity is constrained or poorly coordinated. The industry lacks dynamic pricing, real-time logistics optimization, and integrated capacity planning across multiple producers.

The opportunity: intelligent logistics platforms that optimize routing, coordinate capacity across multiple suppliers, and implement dynamic pricing based on real-time supply and demand. This could reduce transportation costs by 15-25% while increasing asset utilization for trucking fleets.

Equipment maintenance remains reactive rather than predictive.

When a crusher, conveyor, or haul truck fails, it can cost $5,000-10,000 per hour in lost production while repairs are completed. Yet most quarry operators still track maintenance using clipboards, gut instinct, and fixed schedules rather than condition-based monitoring and predictive analytics.

The false economy is obvious once you run the numbers. A $50,000 investment in sensors and analytics could prevent a single catastrophic failure that costs $100,000+ in downtime and emergency repairs. But the aggregates industry has been slow to adopt predictive maintenance technologies that are standard in manufacturing, aviation, and other heavy industries.

The opportunity: predictive maintenance platforms specifically designed for quarry equipment, integrating vibration analysis, thermal monitoring, oil analysis, and usage patterns to predict failures before they occur while automatically ordering replacement parts and scheduling maintenance windows.

Production forecasting and inventory optimization lag decades behind other industries.

Vulcan and its competitors manage enormous inventories of crushed stone, sand, asphalt, and ready-mix concrete, but forecasting systems remain primitive compared to retail, manufacturing, or technology industries. Consequently, they face frequent stockouts during peak construction seasons and overproduction during slower periods, tying up working capital and reducing profitability.

The industry lacks integration between production planning, demand forecasting, and inventory management. Weather data, construction permitting trends, infrastructure pipeline information, and macroeconomic indicators could provide much better demand signals than the historical averages and seasonal patterns most companies rely on today.

The opportunity: AI-powered demand forecasting and inventory optimization platforms that integrate weather data, construction permits, infrastructure project pipelines, and macroeconomic indicators to optimize production planning and reduce working capital requirements.

The biggest opportunity might be vertical SaaS solution that integrates across all these constraints.

A comprehensive platform that handles site identification, permitting acceleration, operations optimization, logistics coordination, maintenance prediction, and compliance reporting as a unified system. Think of it as the digital nervous system for America's infrastructure materials industry, similar to how Palantir serves defense and intelligence agencies.

V. Why not think bigger?

Faster and cheaper mobility will accelerate GDP.

A major obstacle to faster and cheaper mobility is our deteriorating infrastructure that cannot handle the strain of increased mobility.

A major obstacle to repairing, rebuilding and expanding our infrastructure is a supply constrain of construction aggregates — the building blocks of all infrastructure.

The main obstacles constraining the supply of construction aggregates are fertile problem grounds for the next generation of billion dollar companies.

Solving these obstacles will unlock massive trapped economic value and mint a new business in the S&P 500 in 2035.

The United States needs to rebuild its infrastructure foundation to support the next wave of economic growth. That rebuilding will require both the physical assets that companies like Vulcan control and the digital intelligence that startups could provide.

Vulcan will likely survive. It controls irreplaceable assets and faces massive barriers to direct competition. But the real value creation lies in building the digital infrastructure that transforms how the entire industry operates.

These opportunities are complementary, not competitive. The operating system needs logistics coordination. The intelligence platform requires operational data. The regulatory platform depends on real-time compliance monitoring.

The next wave of infrastructure innovation comes from creating digital nervous systems that make existing physical assets exponentially more productive. Winners will understand both the physics of moving atoms and the economics of organizing information.

We live in a unique moment in time: for the first time, the same technological primitives that created trillion-dollar software companies — artificial intelligence, real-time data processing, global connectivity — can be applied to fundamentally physical businesses that have remained largely unchanged for decades.

The economic implications are profound. If digital transformation could reduce infrastructure development costs by 20-30% while accelerating project timelines by similar amounts, it would unlock trillions of dollars in previously uneconomical projects. Remote areas could become economically viable for development. Renewable energy projects could achieve better returns. Housing construction could accelerate in high-demand markets.

Vulcan Materials represents more than just a successful industrial company. It's a case study in how technological transformation is coming for every sector of the economy, including those that seem most resistant to change. The invisible infrastructure is about to become visible, instrumented, and optimized.

The companies that make this transformation happen won't just create economic value — they'll build the foundation for the next generation of American prosperity. In an era where bits have captured most of the value creation, the biggest opportunities may belong to those who understand how to make atoms move better.