Measuring What Matters

An Analysis of LTV/CAC in Offline Channels

Measuring What Matters

As Peter Drucker said, "if you can't measure it, you can't improve it." Understanding the right metrics and having a means to measuring them is essential for operating leverage; and on the opposite side of that token, for investors to diagnose a business and understand the core drivers.

There are periods in the evolution of markets and industries when knowing what to measure presents tremendous information asymmetry for both operators and investors. Today the prevailing metrics are ubiquitous across industries and companies. But that was not always the case. Certain innovations — such as full funnel advertising from social media (mainly Facebook) and first party eCommerce infrastructure (i.e Shopify) enabled merchants to easily measure unit economics by looking at the relationship between the lifetime value of a customer and the cost of acquiring that customer.

Prior to these innovations, it was incredibly difficult to measure profitability on a per customer basis and thus LTV/CAC was far from a ubiquitous metric. Consequently, advertising and other forms of growth marketing were relatively inefficient uses of capital. Instead, the best businesses understood the importance of investing in the customer via other means.

For example, in a conversation with Jeff Bezos, former Walmart CEO Lee Scott once bragged that Walmart only spent 40bps (0.4%) on traditional marketing -- all of their margin was put into lowering prices. Bezos took that lesson and halted TV marketing for the next 7 years. So part of the reason that Amazon was getting beat up by analysts in the early 2000s was that it was impossible to measure the success of Bezos obsession with customer experience. They didn’t understand, nor how to measure, customer lifetime value. This is why Bezos is so brilliant, he understood what matters — optimizing for customer lifetime value — before anyone else did or even had a way to measure it.

New metrics generally correspond to a critical change in the digitization of some aspect of the value chain. By this I mean that new data can be collected: social media marketing enabled the collection of the entire funnel from impression to conversion (and thus CAC), eCommerce infrastructure enabled the collection of unique users, AOV and retention (and therefore LTV), and so on.

Legacy industries will eventually see this and be incentivized to digitize so that they can better allocate their resources. In offline retail, we are seeing the emphasis on digitizing offline stores via spatial technology and marketing technology to capture these variables.

But we still often have limited visibility to what matters in these offline channels.

Let’s explore what that means.

A Return to Retail

For a period of time, direct to consumer eCommerce and digital marketing enabled a new form of distribution that proved to be an effective strategy for growing a brand. However, as opportunity presents itself, opportunity collapses; the invisible hand of competition quickly pushed more supply towards this strategy, eeking out the arbitrage and turning one DTC mattress brand into one hundred. The feature became a bug, and although much has been hyped about eCommerce penetration, demand growth remains underwhelming. ECommerce sales accounted for 13.2% of total retail sales in 2021, down from 13.6% in 2020.

So, it is reasonable to say that new innovation made starting a CPG brand 10x easier, causing supply to increase at a much greater rate than demand, raising the prices of marketing (in the form of increased demand for a fixed number of Facebook ads given flat user growth), in the process slowly eating away any contribution margin. That is, if you have profitable DTC unit economics to begin with — which many brands fail to do. So consumers have an abundance of choices, leading to higher CAC and lower retention (and thus lower LTV), creating a perfect storm for channel collapse. Your customer lifetime revenue is decreasing while your customer acquisition cost is increasing. Ouch.

So we have inflationary effects — too many brands are chasing too few consumers — that are propped up by venture capital and private investments to chase growth. But unlike many technology businesses, where network effects lead to CAC decreasing over time and increasing returns to scale, CPG faces the burden of diminishing returns and increasing marginal costs.

So in this paradigm, offline distribution signals are even more important. Without knowing a brand’s margin profile, distribution signals prove to be the best approximation for capital efficient and durable revenue growth. Similarly, velocities (how fast a product sells in store) are a strong signal of product-market fit and consumer demand.

Which leads me to:

Retail LTV/CAC

How do you compare a dollar of revenue at Target to one at Sephora for a beauty brand? Which suggests a higher probability of long term growth?

Or to put it in more modern digital terms, what is the retailer lifetime value compared to the customer acquisition cost for a given retailer in a particular category?

If you know this as an operator, you can allocate your resources appropriately and enter the offline channel that has the best retail lifetime value; if you know this as an investor you can more precisely identify retails signals, benchmark performance and properly stack rank future cash flows based on the growth potential of one retailer to another.

Indeed, these are really important questions that consumer founders (and investors) face when entering retail and often must make decisions with tremendously imperfect information.

So let’s try to roughly arrive at some analysis to answer these questions. First, we must consider the question: how do you measure customer acquisition cost in retail? What are the important variables?

Remember, customer acquisition cost (CAC) is a measure of sales & marketing efficiency, which itself is a a measure of product-market fit.

CAC is measuring how much demand there is for:

i) the problem you are solving for a particular consumer (product-market fit), and;

ii) how your product solves said problem (product-market fit).

Low CAC can mean that there is both high demand for the problem set as well as for how your product addresses it, whereas high CAC could imply that there is low demand for the problem set, or that there is relatively high demand for the problem set but there is limited differentiation in how your product solves it compared to competitors solving the same problem.

Thus, CAC is a function of both the product and the distribution channel as the distribution channel controls the degree to which similar products of the same problem set (i.e. it’s category) are distributed to consumers, as well as the degree that your product is distributed to relevant consumers.

Today, we often forget about the distribution element of CAC because digital marketing has made connecting supply and demand so efficient and abundant. The distribution channel is essentially the entire population of the Internet, or some 5 billion people.

In an online setting, distribution channels are controlled by third-party aggregators like Facebook and Google that collect vast amounts of user data to determine what the user likes, thereby showing relevant ad products that drive conversion. The distribution channel — whether it is an Instagram feed or Google search result — is dynamically calibrated at each moment to optimize conversion based on this data feedback loop. Every digital instance is an n of 1 instance. In this context, marketing spend is allocated to acquire attention — whether the context of that attention is to scroll on social media, discovery on Google or shop on Amazon — of highly relevant consumers.

Conversely in an offline context, the distribution is fixed rather than dynamic. So, while online customer acquisition relies on third-party intermediaries to aggregate an abundance of demand in order to most effectively connect ads with consumers who are most inclined to convert, offline customer acquisition is a function of supply scarcity.

Thus, shelf space is everything. The less competitors solving a similar problem in a given retailer or channel, the less difficult (and cheaper) it will be to convince consumers to purchase your product. This what I call Retail Demand Elasticity, which measures how demand shifts based on substitute availability. The more substitutes available, the more elastic demand is, and the more difficult (and expensive) it will be to acquire consumers.

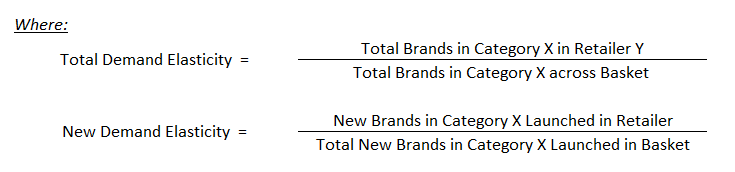

Retail demand elasticity has two components: Total Demand Elasticity and New Demand Elasticity.

Total Demand Elasticity measures the total number of brands in a given category that are sold at a specific retailer. This is measured as a percentage of the total number of brands (inclusive of duplications) sold in a given category across a basket of retailers.

New Demand Elasticity measures the total number of newly launched brands (in a defined period) in a given category that are sold at a specific retailer. This is measured as a percentage of the total number of new brands (inclusive of duplications) launched in a given category across a basket of retailers over said period.

I separate New Demand out from Total Demand as retail demand elasticity is often greater for new brands compared to the overall supply in a given category. This is because of a few reasons.

First, new brand launches usually comes with increased PR and brand engagement, favorable retail support (such as end caps and other promo) and other unique externalities that cause asymmetrical impacts on demand.

Second, to a large degree, retailers bring in new brands to meet new consumer trends and address emerging needs. So, the demand elasticity for new brands is much greater than that for total brands as existing supply either is not addressing a certain problem set or is not doing a good enough job addressing a certain problem set. Thus, in terms of substitute availability, the relative number of other new brands being launched in a specific retailer has a greater impact on demand rather than the relative number of total brands in that retailer as the new brands being launched have a higher probability of addressing the same or similar problem set as the referenced product.

So, we must weight retail demand elasticity to reflect these conditions.

Obviously, the more refined you can make the category grouping of this analysis (i.e. drilling down to color cosmetics from personal care & beauty) the less noise there will be in the sample and the more accurate the proximation will be.

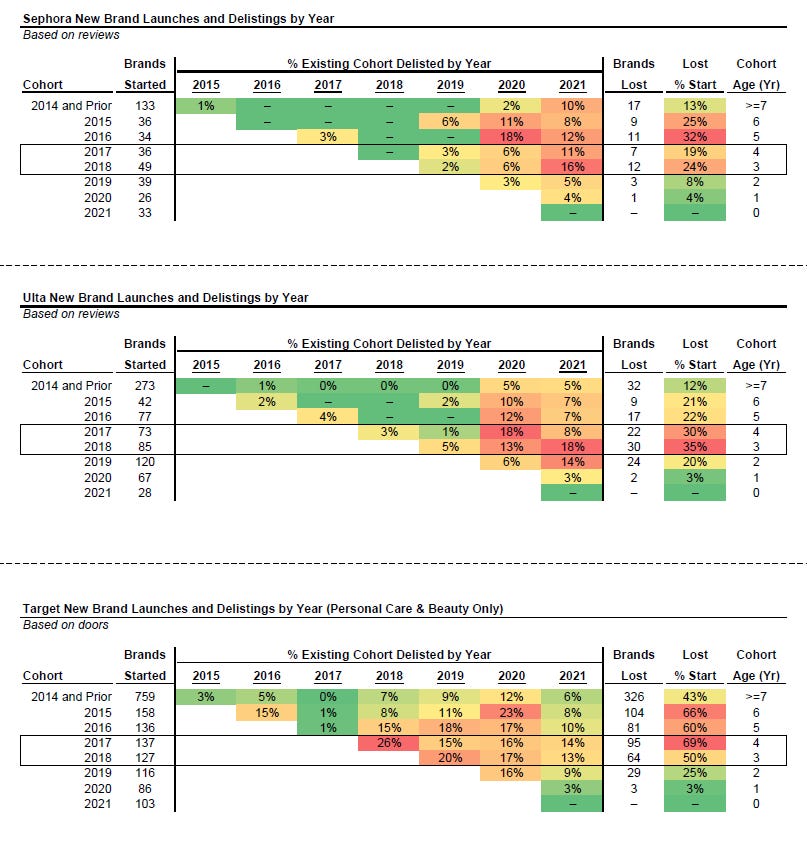

By looking at point of sale scan data and online reviews, My colleague Tommy Walker did some exceptional, I mean exceptional, analysis leveraging Helio that measures new brand launches by category in key retailers.

In Target

In Sephora

In Ulta

What this analysis shows is that on average Target launches 122 new brands a year, Ulta launches 69 new brands a year and Sephora launches 36 new brands a year.

Next we want to understand how much demand there is in a given retailer for a specific category.

One way to do so is to look at the category size at a specific retailer. We will call this Relative %ACV — or the relative percentage of commodity volume a specific retailer does in a category compared to a basket of retailers. You can extrapolate this as directionally aligned with customer acquisition cost; the more business that is done in that channel for that category, the greater the number of total customers and the easier (and thus less expensive) it will be to acquire a customer.

Let’s examine what this looks like for the Personal Care & Beauty category at Target, Ulta and Sephora.

So, Target currently does 2.2x and 2.3x more sales in the Personal Care & Beauty categories than Ulta and Sephora, respectively. While this is far from apples to apples as Target’s merchandising in this category is much more exhaustive, it is a worthy approximation for the purposes of this exercise to determine the size of demand.

Using relative %ACV and weighted retail demand elasticity, we can determine the retail customer acquisition cost.

We get the following:

Thus, Sephora has the lowest retail customer acquisition cost in the category. This implies that retail distribution in Sephora is 88% and 40% more efficient than Ulta and Target, respectively. Or said another way, it costs 88% and 40% less in Sephora to acquire customers than in Ulta or Target, respectively.

Moving on, we must next endeavor to extrapolate the customer lifetime value of a specific offline channel. Keeping retail margin constant, the analysis focuses on two variables: AOV (average order value) and retention.

AOV is another proxy for demand, and thus we can use relative %ACV as an approximation. Secondly, we need to understand how durable revenue is in a certain channel based on the average churn rate (or delisting) at each retailer.

By analyzing reviews, we can determine when a brand churns based on the period of a brand’s last review. Again, Tommy did amazing work here.

We can use churn and Retail Sales to approximate potential LTV for a channel where LTV = Retail Sales / Churn Rate.

From here, we can determine — assuming a constant margin profile — the relative profitability and efficiency of each channel as expressed as LTV/CAC.

And as we can see, Sephora is the most efficient channel in the Personal Care & Beauty category. What this implies is that $1 million of revenue in Sephora equates to $1.6 million of revenue at Target and $2.6 million at Ulta.

Closing Thoughts

New metrics represent a better way to measure operating efficiency; so new metrics inherently mean the existence of a new (and better) operating model. Usually when that occurs, the innovation that enables the better operating model will permeate across all industries, not just the disruptive ones. The shift from 'EBITDA-centric' to 'unit economic-centric' first occurred in SaaS (ARPU vs. CAC), but now analyzing unit economics (and the various internal metrics that compose it) is ubiquitous across industries. We know that LTV/CAC is a better measure of fundamentals than EBITDA, regardless of industry.

As such, retailers are adopting traditional DTC metrics to better segment their customers and find new ways of measuring efficiency so that they can better allocate resources. For example, the fast-fashion mall-based brand Express now reports metrics similar to DTC brands such as online video reach across YouTube, TikTok and Instagram Reels, organic Google brand traffic and monthly app users. “All important indicators of the health and vitality of our brand continue to increase,” CEO Tim Baxter told investors.

Why do they care? Because as Baxter said, its app-based shoppers make on average five more store visits and spend over $300 more per year than those who visit only the store or site. Consequently, allocating marketing resources for these consumers results in greater leverage on each marketing dollar spent.

Other traditional retailers like Macy’s are transforming similarly to focus on first-party data programs and systems.

“To best realize our strategic goal of building profitable lifetime customer relationships, we successfully built a new enterprise data and analytics organization that is helping us to embed data and analytics into everything we do,” CEO Jeff Gennette said.

What they are trying to achieve, at the end of the day, is to separate skill from luck, which is also the goal of this piece. As Michael Mauboussin says, good outcomes can be the result of a bad process and good luck, and bad outcomes can be the result of a good process and bad luck. This analysis is far from perfect and doesn’t take into consideration things like retail margin, price and trade spend — all crucial variables for understanding the efficiency of a specific retailer. More, the parameter of ‘Personal Care & Beauty’ is probably too exhaustive to provide much signal.

But what it does seek to do is separate luck from skill and try to understand the relative efficiency of what matters given imperfect information. The outcome is far from gospel, rather I hope that the thought process of the work informs on the nuances of things like LTV/CAC and how we can creatively use data to approximate this analysis in new context given imperfect information.