In 2017, The Ringer eulogized Game of Thrones as "the very last piece of TV monoculture". The last two seasons aside, the series success was a testament to both the fundamental humanity of its mythos and the supernatural execution of the humans involved. Consequently, on the cusp of it's (controversial) finale, many fans droned that they "will never see the likes of it again".

While GoT may have been the last vestige of monoculture as seen on the small screen, new manifestations of monoculture emerged on even smaller screens across social networks. Instead of dragons, thrones and white walkers, this community reveled in dark spots, topicals and white heads. These consumers sought each other out for beauty guidance on Facebook, shared their regimens and routines on Youtube, educated each other on ingredients and supply chains on Reddit, pinned inspiration on Pinterest, became Skinfluencers on Instagram, and much, much more. In the process, they created a new source of monoculture that was composed of more diverse subcommunities than Westeros itself.

Yet, while these networks are still very much components of the collective narrative, a new wave of platforms and tools developed specifically for the beauty community has emerged in the periphery.

(Diving into each one of these tech evolutions will be the subject of another post.)

Livestreaming

Rather than replicate the same formula of Web2 social media networks, emerging social commerce platforms have extrapolated trends and behaviors from foreign sources. Livestream commerce, for example, is a $125 billion market in China, and while still nascent in the US, livestreaming has begun to experience rapid adoption, expecting to reach $11 billion by the end of 2021 — up from $5 billion in 2020.

Beauty’s hyper interactive consumer base has clear product-market fit for livestreaming, where a core element of the customer journey is watching influencers review and try on products. This has quickly manifested in both the mainstream, with Walmart devoting its second shoppable livestreaming event solely on beauty, and around the edges — with the eSports and Twitch community deepening their beauty ties.

Beauty retailers are also taking note. Ulta, one of the largest beauty retailers in the US, announced a partnership with livestreaming shopping app Supergreat at the end of July. Sephora, on the other hand, has decided to partner with Facebook for a weekly shoppable livestreaming show.

Mark Zuckerberg specifically called out this initiative during Facebook's Q2 Earnings Call.

I also want to call out live video for a moment. This is a smaller percent of overall video on our services, but it's some of the most unique content and it gives creators a way to build community and engage with their followers. We're also focused on developing monetization tools like Live Breaks for mid-roll ads and Live Shopping so creators can make a living and engage their communities more deeply in commerce with their content.

In some cases, livestreaming has been the primary GTM strategy for product drops and brand launches. Kyle Cosmetics, for example, relaunched on July 15th via a shoppable livestream hosted by Kylie herself on their site. After going live, the livestream was said to have “broke the internet”, crashing for a few minutes as users flooded the site.

A number of new platforms have launched specifically focused on livestream commerce. Many of them have a Gen-Z bent, sporting vibrant color palletes and composable motifs that are native to this demographic. This makes sense given Gen Z and millennial cohorts had the highest livestreaming usage rate worldwide in 2020, according to data from Euromonitor. In China, millennials used livestreaming the most at 41.9%, and in the U.S., Gen Zers used it the most at 21.5%.

While livestreaming is a much larger opportunity than just beauty — with everyone from Walmart to Petco entering the foray — this category has seen the most innovation and user adoption.

Here are some emerging companies in the space:

Supergreat

Supergreat is a a community of real beauty fans sharing routines, reviewing products, and shopping daily drops. Creators upload 60-second product review videos and are incentivized to share, comment and engage.

The app currently consists of 94% women, and its audience is primarily Gen Z with 65% of its users between 16 and 24 years old. The average daily time spent on the app is 20 minutes, with its highest-selling livestream selling $60 in GMV per minute for a period over 40 minutes.

Newness

Newness is a livestreaming platform built specifically for the beauty community. Creators talk about brands they love, customers can ask them questions and discuss with other customers in real time. Think Twitch for beauty.

ShopLit Live

ShopLit Live is a mobile livestreaming marketplace where users can interact, discover, and shop live videos from brands and influencers.

PopShop Live

PopShop Live is a livestreaming ecommerce platform focused on emerging brands with an edge. It focuses on selling interesting things from interesting people, and integrating elements of socializing via chat streams that run alongside selling videos. It recently raised $20m at a $100m valuation led by Benchmark.

Social Commerce

The old industry joke of yesteryear was that "every company is a media company". Today, it seems like that axiom has evolved to be "every company is a social network". Whether that's for investing (commonstock), fitness (Peleton, Strava), gaming (steam), digital product hobbyist (Product Hunt), or local communities (Nextdoor), new vertical social networks have sprouted up in nearly every industry in effort to unbundle Web 2.0 monoliths. The same holds true in beauty, with new platforms looking just as much like networks as they do marketplaces.

Some cool new social commerce platforms:

Flip

Flip is mixing live commerce mobile apps with real customer reviews to improve the buying experience and opportunity for the creator economy, mixing in user-generated reviews and live shopping shows for beauty, wellness and health brands. Flip only allows users that have purchased products on the platform make videos, part of their effort to bootstrap trust and authenticity.

Beaubble

Beaubble is building a community-driven “open studio” for beauty with the goal of building a platform that enables anyone, starting with influencers, to create and launch a personalized cosmetics product. It dubs itself a “playground” for beauty enthusiasts.

The Lobby

The Lobby allows influencers to review and create content for brands and sell directly to customers on the platform. Think Instagram meets Patreon meets Depop.

Clear

Clear is a debit card just for cosmetics and skin care, giving cash back on numerous brands. On top of that, Clear is building a social network layer for users to track and share their skincare routines and products. Think Venmo meets Twitter.

Community/Edutainment

Beauty brands live and die with their community. Beauty consumers rely on C2C (customer to customer) forums and reviews to learn about new trends and routine, diligence and compare products, and ultimately guide their purchasing behavior. Previously, this has been done on platforms like Facebook and Reddit, but emerging platforms are challenging these networks by offering tools and feautres specifically built for the beauty community.

Skinskool

Skinskool is a database of skincare products that compares formulas to find the most similar options to your favorites.

Picky

Picky is a Reddit-like platform for skincare product reviews, discussion boards, ingredient analysis, product testing events and more.

NuNotions

NuNotions is a Yelp-like platform for inclusive beauty products. Currently in Beta.

Trends at the Product Level

Multiple consumer trends are driving changes at the category and product level. Demand for ‘clean’ ingredients, more accessible price points and one-size-does-not-fit-all brands are a few that have gained momentum.

Here are some of my favorite trends right now and a few brands leading the charge:

Hyperpigmentation (Thesis below)

Hyper Skin, Topicals, Eadem, Rosen, Brown Girl Jane

Gen Z Beauty

About Face, Inn Beauty Project, Squish, Youthforia, Kulfi Beauty, Bubble, Blume, Kinship, Hally, PYT Beauty, TooD Beauty, Kiramoon, Faculty

Skinification of Hair

Ceremonia, Naturall Club, Rizos Curls, Melanin Haircare, Crown Affair, Scotch Porter, Fable & Mane, Bread Butter Supply, Act + Acre

Men's Grooming

Disco, Stryke Club, Stryx, Huron, Geanologie

Clinical > Clean

Soft Services, Dieux, Kosas

Salon to Home (wigs, hair extensions, hair removal, nail care)

Upgrade Boutique, Radswan, Weave, Rebundle, ManiMe, Static Nails, Clutch Nails, Chillhouse, Sugardoh

Unique form factor (Patches, Waterless)

The Good Patch, Susteau, Everist

Hyperpigmentation & The 'Beyond Acne' Consumer

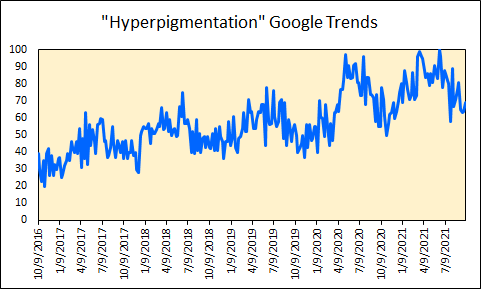

Consumers skincare needs have evolved 'beyond acne'. Specifically, consumers are increasingly aware of dark spots caused by hyperpigmentation. This skin condition indexing towards BIPOC individuals, as it is the number one skincare concern for women of color.

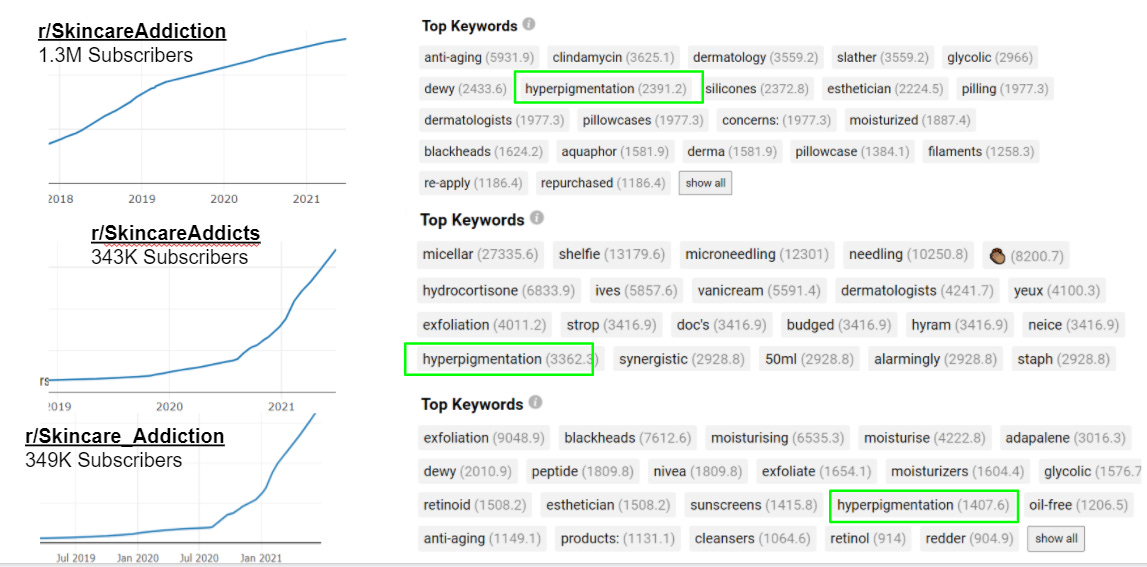

Hyperpigmentation is also a top keyword across the three most popular skincare-focused subreddits.

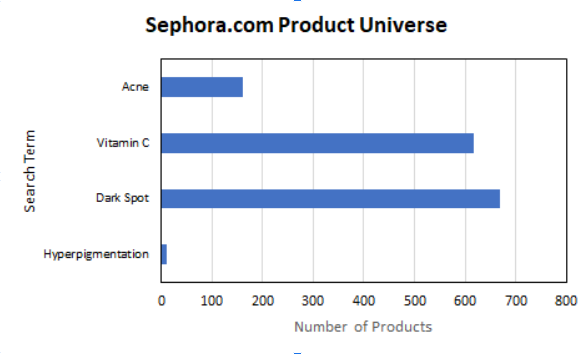

From a merchandising standpoint, retailers and brands alike are focused on speaking to the external, rather than underlying, skincare condition. Just like pimples are the externalization of acne, dark spots are the externalization of hyperpigmentation.

Sephora, particularly, has demonstrated interest in investing in this category.

However, as of 1H 2021, the existing dark spot and hyperpigmentation universe has been concentrated, with five products constituting nearly 75% of reviews (a proxy for sales). The majority of these products were launched quite recently, a sign that Sephora’s investment in the space is translating to significant traction.

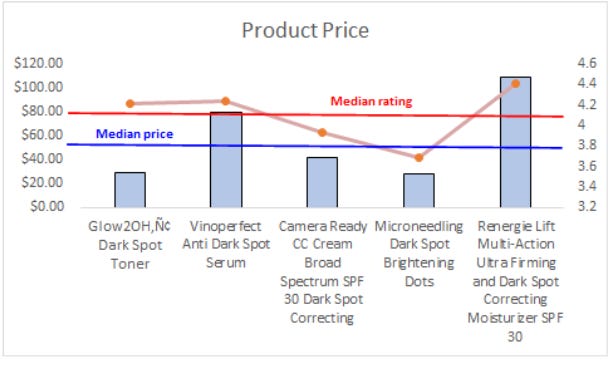

However, these products do not appear to be resonating with consumers from a differentiation or efficacy standpoint, with review ratings hovering around the median (and sometimes vastly underperforming). Price, on the other hand, seems to be more critical as 60% of these products are priced below the median category price point, two of which are almost 50% below.

This convergence toward a masstige price point is in line with broader category trends that we are seeing play out in Sephora.

With that being said, for the hyperpigmentation set, ingredient profile seems to be a strong differentiator. Vitamin C, particularly, is resonating with consumers compared to other ingredients like Niacinamide and Tranexamic Acid.

The first half of 2021 was an inflection point for the hyperpigmentation category, with a 57% increase in new product launches. In particular, products with Vitamin C/Activated C doubled in Q1 2021, and 50% of new products contained Vitamin C ingredients.

Yet, Vitamin C still trails other ingredients in number of products and sales. The reason for the latter could be be because of a) recency of launch (although unlikely since Q1 2021 brands saw the most # of reviews) and/or b) price.

As such, the winners in this category will be brands that can intersect premium product positioning (via ingredient profile) and a masstige price point. A number of brands like Hyper, Topicals, Eadam, are already doing so, and I remain excited to track them as they scale.

Final Thoughts

Beauty has been an early adopter of emerging trends that intersect social media and commerce. As every platform becomes a social network, beauty is a particularly exciting vertical given the hyper-engaged nature of its consumer base. Existing social media platforms like Instagram and Youtube provided these communities with a microphone that propelled certain category and product level trends and has led to significant changes at retail. New platforms specifically focused on unbundling beauty communities from social media platforms will only continue to accelerate emerging trends both online and offline.